Ehsaas Apna Ghar Scheme

The Government of Pakistan has introduced the Ehsaas Apna Ghar Scheme, offering up to 15 lakh rupees in loans for individuals looking to construct or purchase their dream house. This initiative is part of the Ehsaas program, designed to support low-income families and promote affordable housing in the country.

Let’s dive into the details of this scheme, eligibility, the application process, and other essential information.

Read More: Latest Update for January 2025 Payments

Table of Contents

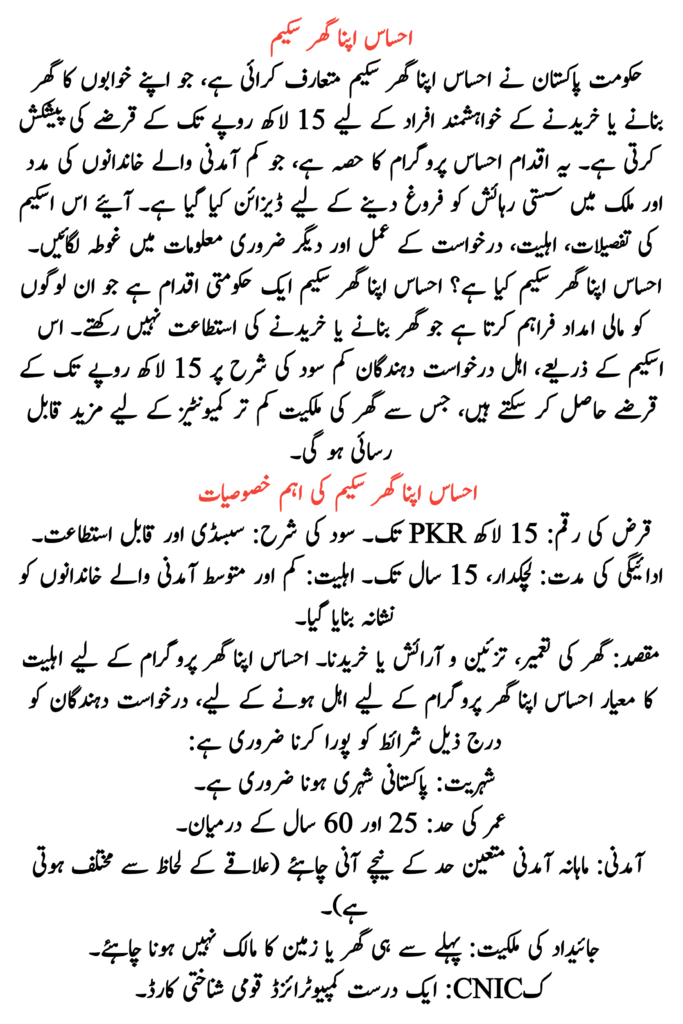

What is the Ehsaas Apna Ghar Scheme?

The Ehsaas Apna Ghar Scheme is a government initiative providing financial assistance to people who cannot afford to build or buy a house. Through this scheme, eligible applicants can receive loans up to 15 lakh rupees at low-interest rates, making homeownership more accessible for the underserved communities.

Key Features of the Ehsaas Apna Ghar Scheme

- Loan Amount: Up to 15 lakh PKR.

- Interest Rate: Subsidized and affordable.

- Repayment Tenure: Flexible, up to 15 years.

- Eligibility: Targeted toward low- and middle-income families.

- Purpose: To construct, renovate, or purchase a house.

Read More: Ehsaas Program 10500 New Installment

Eligibility Criteria for the Ehsaas Apna Ghar Program

To qualify for the Ehsaas Apna Ghar Program, applicants must meet the following conditions:

- Citizenship: Must be a Pakistani national.

- Age Limit: Between 25 and 60 years.

- Income: Monthly income should fall under the defined threshold (varies by region).

- Property Ownership: Should not already own a house or land.

- CNIC: A valid computerized national identity card.

How to Apply for the Ehsaas Apna Ghar Scheme?

Follow these simple steps to apply:

- Visit the nearest Ehsaas Program Center or the official Ehsaas web portal.

- Fill out the application form with accurate details.

- Attach the required documents (see below).

- Submit the form online or at the center.

- Wait for verification and loan approval.

Read More: Graduation Program

Required Documents for Apna Ghar Scheme

Applicants must provide the following documents:

- Valid CNIC.

- Income proof (salary slips or bank statements).

- Property ownership documents (if renovating).

- Utility bills (for address verification).

- Passport-sized photographs.

Loan Disbursement and Repayment for Apna Ghar Scheme

Once approved, the loan amount will be disbursed directly to the applicant’s bank account. The repayment process is made easy with:

- Low monthly installments.

- Flexible repayment terms (up to 15 years).

- Assistance in case of unforeseen financial hardships.

Benefits of the Ehsaas Apna Ghar Scheme

| Feature | Details |

| Loan Amount | Up to 15 lakh PKR |

| Interest Rate | Subsidized, low rate |

| Repayment Tenure | Up to 15 years |

| Eligibility | Low- and middle-income families |

| Application Process | Simple and online availability |

FAQs

1. Who is eligible for the Ehsaas Apna Ghar Scheme?

- Anyone who is a Pakistani citizen, aged 25-60, with a low monthly income and no prior homeownership, can apply.

2. How much loan can I get under this scheme?

- You can get up to 15 lakh rupees depending on your financial needs and eligibility.

3. Where can I apply for this scheme?

- You can apply through the Ehsaas Centers or the official Ehsaas web portal.

4. What documents are required for the application?

- Required documents include a valid CNIC, income proof, utility bills, property documents (if applicable), and passport-sized photos.

5. What is the repayment tenure?

- The loan repayment period is up to 15 years with low monthly installments.

Conclusion

The Ehsaas Apna Ghar Scheme is a groundbreaking step by the government to provide affordable housing solutions to deserving citizens. With a maximum loan amount of 15 lakh rupees, low-interest rates, and flexible repayment options, this scheme aims to make the dream of owning a home a reality for many.

Read More: Punjab Educational Endowment Fund (PEEF)

We appreciate our CM Punjab and Govt of Punjab for start Housing scheme to help our needy families in Punjab.President All India Muslim League Political Party Subcontinent Asia Barrister kashif Bilal Rajput Candidate for Chancellor role University of Oxford uk International and on national level political struggling for freedom of our jamu and Kashmir which is in unlawful possession of India for 77 years we are unite west Pakistan East Pakistan and India Muslim for freedom of our Jamo and Kashmir.Under Parliament of uk and Resolution of UN

کوئی جواب تو دو ہم نےکافی مرتبہ اپلائی کیا لیکن کوئی جواب نہیں آیا

شناختی کارڈ نمبر

3660201251224

Good way for needy people

Maryam nawz is a good CM

I have solar panels

8171

Qurandazi

15 lakh rupees madad

15 lakh ki madad

I’m interested in this program so needed

Apni chat

15lack Loan apply for housing

Inshallah Allah pak Khar Kara ga

ijaz97391@gmail.com 3230479003261. Muhammad ijaz dakhana Shivajimall muzaffargarh

15 lakh Ka lone chaiya

S

Laon

میرے نام پے گھر نکلا ہے لیکن ملا نہیں ہے یہ سب ٹوپی ڈرامہ ہے

hy sir hamy payment ke zarort hay may nay ap na makan bana hay

hy sir hamy payment ke zarort hay may nay ap na makan bana hay mare umar 25 sal hay may 7 sal kay bad du ga

I don’t have money

میں گھر لینے کے لیے قرضہ لینا چاہتا ہوں

Like it’s

I need home

Plz hel me I am make a house

Plz give me loan I am make a house

Mujhe 15lakh chahye please please please please please me phir de su ga

Main Apana Ghar lian laina Chahta hon

100000

g main n apna ghair banwana hy

Ghr bana ney k lia

Mujhe benaxir income support SE ehliyat kese milegi

Shaam laatt walo Ko B Ed category Mein Lee K ayen

Shaam laatt walo Ko B Ed category Mein Lee K ayen Jazzak Allah

Plz Shaam Laatt walo Ko B Dey Mein documents Jama Karwaye Hoye Hain Wo Kehty Hain Shaam Laatt Ko Nai Dey Rahe

Jabar. Ali