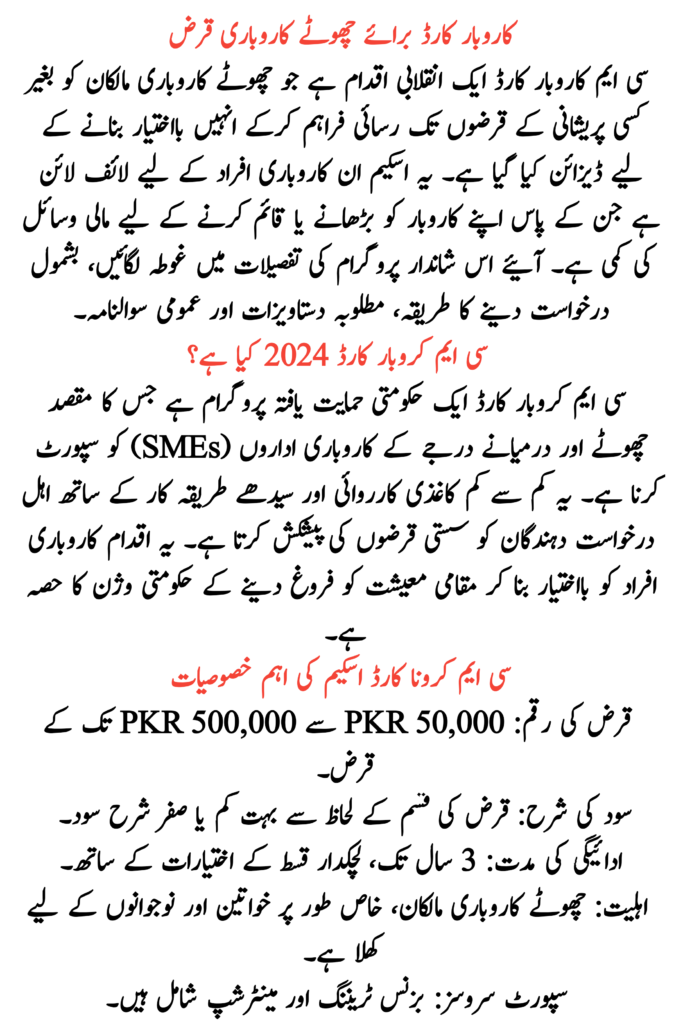

Karobar Card for Small Business Loan

The CM Karobar Card is a revolutionary initiative designed to empower small business owners by providing them access to hassle-free loans. This scheme is a lifeline for entrepreneurs who lack the financial resources to expand or establish their businesses. Let’s dive into the details of this fantastic program, including how to apply, the required documents, and FAQs.

Read More: Latest Update for January 2025 Payments

What Is the CM Karobar Card 2024?

The CM Karobar Card is a government-backed program aimed at supporting small and medium enterprises (SMEs). It offers affordable loans to eligible applicants with minimal paperwork and straightforward procedures. This initiative is part of the government’s vision to boost the local economy by empowering entrepreneurs.

Key Features of the CM Karobar Card Scheme

- Loan Amount: Loans ranging from PKR 50,000 to PKR 500,000.

- Interest Rate: Very low or zero interest rate depending on the loan type.

- Repayment Period: Up to 3 years, with flexible installment options.

- Eligibility: Open to small business owners, especially women and youth.

- Support Services: Business training and mentorship are included.

Read More: Ehsaas Program 10500 New Installment

How to Apply for the CM Karobar Card for Small Business Loan?

Step-by-Step Application Process

- Visit the Official Website

Go to the government’s official Karobar Card portal. - Create an Account

Register with your CNIC number, mobile number, and email. - Fill Out the Online Form

Provide details about your business, income, and loan requirements. - Attach Required Documents

Upload all necessary documents (see the list below). - Submit the Application

Double-check your details and submit the application. - Receive Confirmation

Once your application is approved, you’ll receive a confirmation SMS or email.

Read More: Graduation Program

Required Documents for Karobar Card for Small Business Loan

- Copy of CNIC

- Proof of Business (registration or operational evidence)

- Bank Statement (last 6 months)

- Two Passport-Sized Photographs

- Utility Bills (last 2 months)

- Income Proof (if applicable)

Table: Key Details of CM Karobar Card Scheme

| Feature | Description |

| Loan Amount | PKR 50,000 – PKR 500,000 |

| Interest Rate | Low or zero interest |

| Repayment Period | Up to 3 years |

| Eligibility | Small business owners, women, and youth |

| Application Mode | Online through the official portal |

Benefits of the Karobar Card Scheme

- Financial Freedom: Easy access to funds for business growth.

- Support for Entrepreneurs: Encourages innovation and expansion.

- Economic Growth: Boosts the local economy by promoting small businesses.

Conclusion

The CM Karobar Card for Small Business Loan is a game-changer for small business owners in 2024. With its low-interest loans and easy application process, it provides a unique opportunity to grow your business without financial stress. Don’t miss out—apply today and take the first step toward achieving your entrepreneurial dreams.

Read More: Punjab Educational Endowment Fund (PEEF)

FAQs

1. Who is eligible for the CM Karobar Card?

- Small business owners, women, youth, and entrepreneurs looking to start or expand their businesses.

2. What is the interest rate for the loan?

- The loan comes with a very low or zero interest rate, depending on the type of loan.

3. Can I apply offline?

- No, the application process is entirely online through the official portal.

4. How long does it take to get approval?

- It typically takes 2–4 weeks for the application to be processed and approved.

C M Maryam Nawaz sharif saheba is saceem ka ham ko koi fida nai mily or na he ham ko ya karza mily ga

Loan apply plz I am needy

I m needy

Plz I am needy I am apply loan 5 lac

السلام علیکم

جتنے ہم محترم مریم نواز صاحبہ ہمیں قرض کے لیے رقم درپیش ہے برائے مہربانی اگر اپ ہم مہربانی کریں اور قرض دیں ہم اپ کے شکر گزاریں گے اور انشاءاللہ بہت جلد رقم واپس ادا کر دی جائے گی کاروبار کرنے کے بعد

سرگودھا سلا والی روڈ 90 سٹاف سلیم چار بھائی فون نمبر 03057154281

Headline: Verify Your Benazir Kafalat Status in 3 Steps Today