Features and Benefits of the Karobar Card Loan Scheme

The Punjab Government has unveiled the Karobar Card Loan Scheme, a groundbreaking initiative aimed at empowering entrepreneurs and supporting economic growth. This scheme promises accessible financial assistance to small and medium-sized businesses, fostering innovation and sustainability in Punjab’s economic landscape.

Also Read : Benazir Kafaalat 13500 Bank Withdrawal And Payments Status Check

Features of the Karobar Card Loan Scheme

The Karobar Card Loan Scheme is designed to provide financial support to small and medium enterprises (SMEs) with features tailored to meet their unique needs.

- Loan Amount: Entrepreneurs can secure loans ranging from Rs. 100,000 to Rs. 1 million, providing flexibility based on their business requirements.

- Interest-Free Loans: These loans are offered without any interest, ensuring affordability for startups and growing businesses.

- Flexible Repayment Options: Borrowers have the convenience of a five-year repayment period, enabling them to focus on business growth.

- Inclusive Coverage: The scheme aims to support a diverse range of industries, ensuring broad access to financial resources.

This initiative reflects the government’s commitment to supporting SMEs and creating opportunities for entrepreneurs to thrive.

Also Read : Register Now for Free Tractors and Laser Land Levelers!

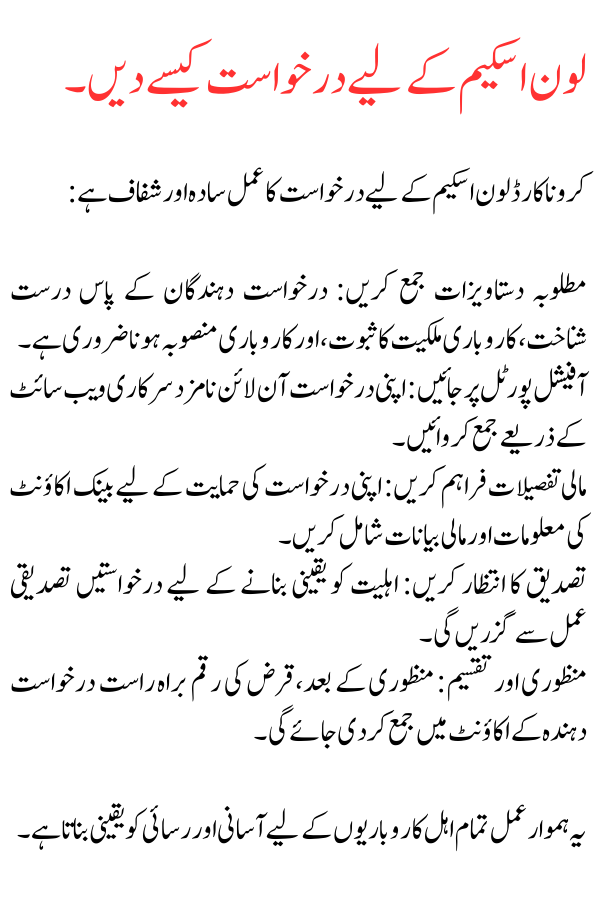

How to Apply for the Loan Scheme

The application process for the Karobar Card Loan Scheme is simple and transparent:

- Gather Required Documents: Applicants must have valid identification, proof of business ownership, and a business plan.

- Visit the Official Portal: Submit your application online through the designated government website.

- Provide Financial Details: Include bank account information and financial statements to support your application.

- Wait for Verification: Applications will undergo a verification process to ensure eligibility.

- Approval and Disbursement: Upon approval, the loan amount will be disbursed directly to the applicant’s account.

This streamlined process ensures ease and accessibility for all eligible entrepreneurs.

Eligibility Criteria for the Loan Scheme

To qualify for the Karobar Card Loan Scheme, applicants must meet the following criteria:

- Be a resident of Punjab.

- Own a small or medium-sized business registered with the appropriate authorities.

- Demonstrate a viable business plan that aligns with the scheme’s objectives.

- Have a clean financial history and no prior defaults on government loans.

The eligibility requirements are designed to ensure fairness and support deserving candidates.

Also Read : What to Do After Receiving the Honhaar Scholarship Award Letter

Loan Distribution and Transparency

The Punjab Government has implemented robust measures to maintain transparency in the loan distribution process:

- Automated System: Applications are processed through a computerized system to eliminate bias.

- Periodic Audits: Regular audits are conducted to ensure the funds are used for the intended purposes.

- Public Updates: Beneficiaries and progress reports are made available to the public, fostering accountability.

This approach guarantees that the loans reach the right individuals and contribute effectively to economic growth.

Benefits of the Scheme

The Karobar Card Loan Scheme offers numerous benefits for businesses and the economy:

- Job Creation: By empowering SMEs, the scheme creates employment opportunities across Punjab.

- Economic Growth: Increased commercial activity strengthens the overall economic landscape.

- Encourages Innovation: Entrepreneurs can invest in new technologies and ideas.

- Reduces Financial Barriers: Interest-free loans make it easier for small businesses to access much-needed capital.

The scheme is a testament to the government’s vision of fostering a thriving business ecosystem in Punjab.

Conclusion

The Karobar Card Loan Scheme is a transformative initiative that underscores the Punjab Government’s dedication to economic empowerment. By offering accessible financial assistance, it enables small and medium-sized businesses to overcome challenges, innovate, and contribute to the province’s growth. Entrepreneurs are encouraged to seize this opportunity to elevate their ventures and drive Punjab toward a prosperous future.

Sargodha silwali wale road 90 stop

Free solar scheme

I am interested your loan i am shopkeeper my bissness cloth i need loan

I am waiting for your massge please contact me

No

Mujhe chye qarza please please please please please please please please please me ne qarobar kerna hi paise ni hi me AK saal ke andar andar de su ga please please please please please please request please please please please