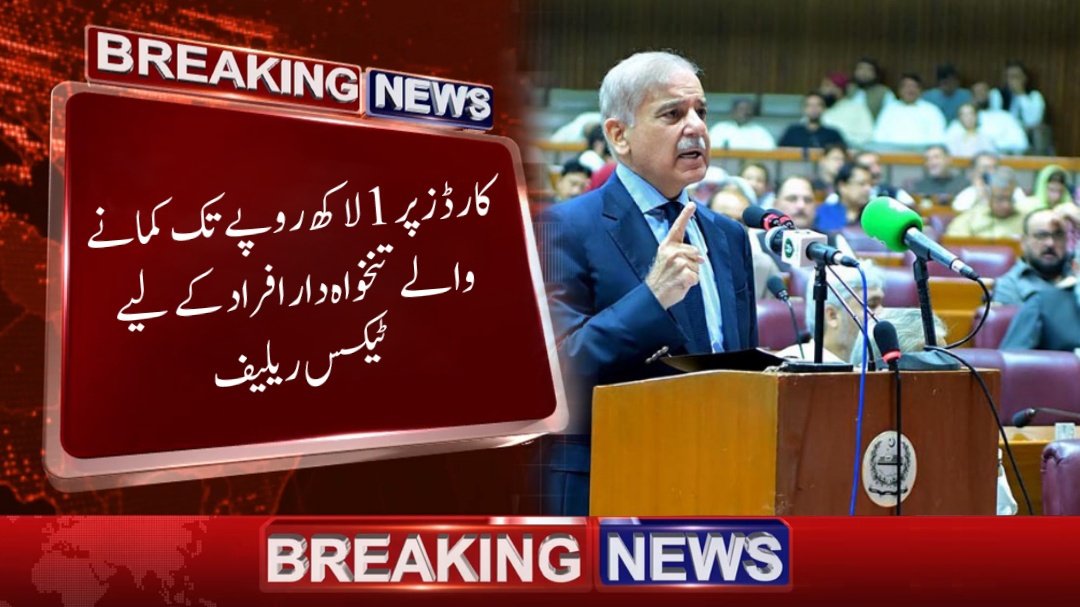

The government is considering tax relief for salaried individuals earning up to Rs1 lac (100,000 PKR) per month. This initiative aims to ease the financial burden on low-income earners.

Purpose of Tax Relief

The primary goal of this tax relief is to support salaried individuals who struggle with the high cost of living. By reducing their tax liability, the government intends to increase their disposable income, thereby improving their overall financial well-being. This measure is expected to help many families who find it difficult to manage their expenses.

Tax Slabs in Pakistan

| Salary Range | Tax Rate | Old Tax | Updated Tax |

|---|---|---|---|

| Up to Rs 50,000 | No Tax | – | – |

| Rs 50,001 to Rs 100,000 | 5% | Rs 1,250 | Rs 2,500 |

| Rs 100,001 to Rs 183,344 | 15% | Rs 11,667 | Rs 15,000 |

| Rs 183,345 to Rs 267,667 | 25% | – | – |

| Rs 267,668 to Rs 341,667 | 30% | Rs 47,468 | Rs 53,333 |

Eligibility Criteria

To be eligible for this tax relief, individuals must earn up to Rs1 lac per month. This initiative targets low-income earners who are most affected by inflation and rising living costs. By focusing on this group, the government aims to provide significant financial support to those who need it the most.

Implementation Process

The implementation process for this tax relief will involve changes to the existing tax regulations. The government will issue new guidelines outlining the specific procedures for availing of this relief. It is essential for eligible individuals to stay informed about these updates to benefit from the new policy.

Expected Benefits

This tax relief is expected to provide several benefits, including increased disposable income for eligible individuals, reduced financial stress, and improved economic stability for low-income families. By easing the tax burden, the government aims to enhance the quality of life for many citizens.

Government’s Commitment

The government is committed to supporting low-income earners through various initiatives. This tax relief is part of a broader strategy to address economic challenges and promote financial stability. The government plans to continue introducing measures that support the well-being of its citizens.